Lifestyle Spending Accounts Become the Top Benefits Companies Offer Their Employees – Spiceworks (Aug, 2023)

Fitness, mental health, and nutrition are among the top perks offered by organizations as part of lifestyle spending accounts.

- In today’s tight talent market, benefits play a significant role in attracting and retaining employees.

- So, what are the recent trends in benefit programs?

- Benepass recently conducted a study to identify to gain some insights.

In a tight labor market where organizations are finding hiring the right talent challenging, workplace benefits play a huge role in attracting and retaining talent. According to Morgan Stanley at Work’s recent study, 60% of employees are re-evaluating their financial benefits this year, given the current macroeconomic shifts and market uncertainty. As such, many companies are focusing on offering attractive benefits programs to emerge as the employer of choice.

This is where benefits benchmarking plays an important role, as it helps organizations understand if they provide programs that stand out and how their benefits compare to those of their competitors.

Benepass recently conducted a study to identify the key benefits trends. Here are a few insights and tips for developing a competitive benefits program.

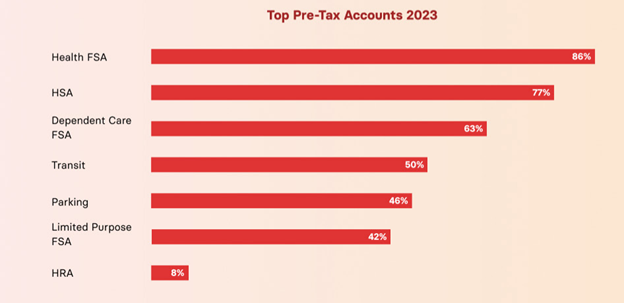

Healthcare FSAs and HSAs Top the List of Pre-Tax Benefits

The overall benefits program can be segmented into pre-tax benefits and perks. While pre-tax benefits reduce an employee’s taxable income, perks are taxable when spent.

Regarding pre-tax benefits, the study found that health flexible spending accounts (FSAs) emerged as the most popular pre-tax benefit, followed by health savings accounts (HSAs). They were followed by dependent care FSAs (DCFSAs), parking, limited purpose FSA, and home rental allowance (HRA). Health FSAs, HSAs, and DCFSAs remained the top three pre-tax benefits organizations offered their employees both last and this year.

Lifestyle Spending Account Tops the List of Perks

Regarding perks, lifestyle spending accounts (LSAs) topped the list of benefits, with 51% of employers offering them compared to 37% last year. As companies increasingly understand the flexibility of these accounts, we can expect the LSAs to continue growing. This was followed by fitness and wellness (45%) and work-from-home (43%) benefits. About 24% also offered professional enrichment perks, 22% offered food perks, and 12% provided internet and phone benefits. Only 5% offered parental support perks.

Compared to the perks offered last year, LSAs overtook fitness and wellness benefits to reach the top. Work-from-home (WFH) perks became more popular this year though the average contribution was reduced. Further, a few benefits, like entertainment and commuter benefits, were missing this year. This may be due to the increasing popularity of LSAs. Companies may have also considered consolidating a few categories into an LSA.

While most benefits and perks were offered on a monthly basis, some were provided on a quarterly, semi-annual, or annual basis. In some instances, like WFH, companies offered a one-time benefit to their employees.

Regarding perks based on different company sizes, LSA topped the list for both large and medium-sized companies. While WFH perks ranked second for large companies, fitness and wellness benefits ranked second for medium-sized companies. WFH and fitness and wellness perks ranked as the top two benefits for small companies this year, while LSA ranked third. That said, the percentage of companies offering LSA has increased this year, irrespective of the company size.

Fitness and wellness benefits also saw a decent rise among small and medium companies. Further, smaller companies were seen to offer more perks than medium and large-sized companies. Smaller companies may see it as necessary if they have to compete with larger companies to attract top talent.

Fitness and Mental Health Perks Top the List of LSAs

Lifestyle spending accounts (LSAs) can cover a plethora of perks. Organizations are harnessing LSA’s flexibility to spin up eligible categories in response to current events. Further, many Millennials and Gen Z employees specifically want to work with value-driven companies. Providing opportunities for employees to donate money to social causes shows a commitment to strong values. Moreover, LSA works as a great benefits option for companies wanting to support employees’ holistic wellness and lifestyle needs in a way that promotes equity and inclusion.

The study found that fitness and mental health emerged as the top categories of spending within an LSA, irrespective of the company’s size. Nutrition and spa are also ranked among the top five categories of spending in an LSA. Charitable giving emerged as a new category of LSA spending this year.

Tips To Benchmark and Develop a Competitive Benefits Program

The following are a few quick tips for benefits benchmarking and program development.

- Conduct thorough research. As part of it, identify the industry standards and best practices. Also, identify what benefits are most valued by employees in today’s scenario.

- Prioritizing holistic well-being is the secret to creating a competitive benefits program. Comprehensive benefits packages that support employees’ physical, mental, and emotional well-being are in high demand.

- Offer as much flexibility as possible in your benefits program within the scope of your business services and operations.

- Consider all definitions of wellness, as it may mean different things to different people.

- Prioritize inclusivity. And the best way to build an inclusive benefits program is to have an LSA.

- As your organization and teams grow, take employee demographics into account.

- Ultimately, provide those benefits that improve the employees’ quality of life

Benefits That Fit Your Employees Best

In times when industries find it challenging to attract the right talent, traditional one-size-fits-all benefits don’t cut it. People want to work for organizations that care for their personal and professional well-being. As such, doing proper research, benchmarking, and developing a flexible benefits program is one of the best strategies to attract and retain top talent.